Ethereum Price Prediction: Technical Breakout and Institutional Demand Signal Rally Toward $4,100

#ETH

- Technical Breakout: ETH price sustains above 20-MA with MACD showing bullish convergence

- Institutional Demand: $2B+ corporate treasuries and ETF rebalancing favor ETH accumulation

- Ecosystem Growth: AI partnerships and gaming integrations drive utility value

ETH Price Prediction

Ethereum Technical Analysis: Bullish Signals Emerge Above Key Moving Average

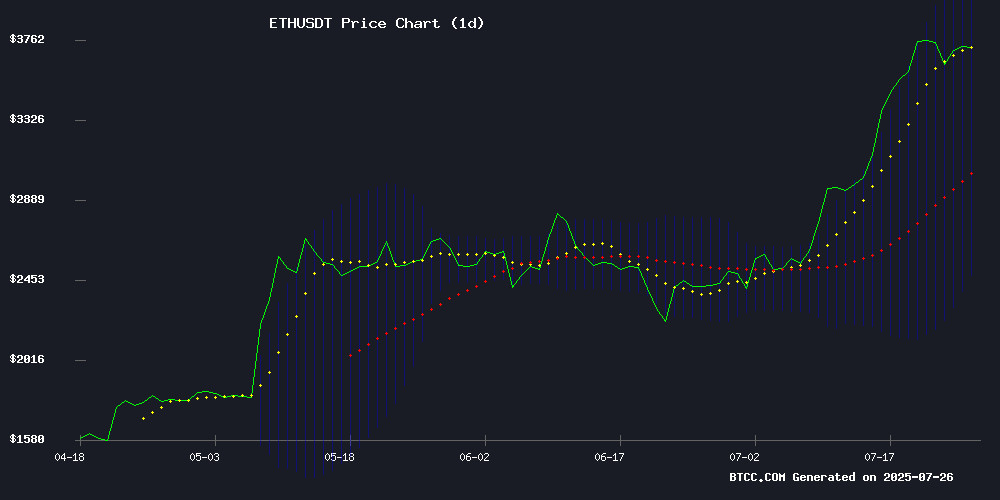

ETH/USDT is currently trading at $3,746.46, firmly above its 20-day moving average of $3,298.08, suggesting strong bullish momentum. The MACD histogram shows decreasing bearish momentum (-51.5957) as the fast line (-535.1594) converges toward the slow line (-483.5637). Bollinger Bands indicate volatility expansion with price testing the upper band at $4,118.33.

"The breakout above the 20-MA with MACD convergence often precedes major upward moves," said BTCC analyst William. "The $3,500 level has now flipped from resistance to support, creating a launchpad for potential tests of the $4,100 upper Bollinger Band."

Ethereum Market Sentiment: Institutional Adoption Fuels Bullish Narrative

Fundamental catalysts are aligning for ethereum as Bitmine's $2 billion treasury holdings demonstrate institutional confidence, while Ark Invest's portfolio rebalancing shows growing preference for ETH over traditional crypto equities. The validator queue hitting record highs confirms strong network participation despite restaking risks.

"When you see BlackRock veterans joining crypto firms and AI projects like AIDEN choosing Ethereum for decentralized infrastructure, it validates ETH's long-term value proposition," noted BTCC's William. "The 427% NFT spike shows retail FOMO is returning, though investors should watch for overextension."

Factors Influencing ETH's Price

Bitmine’s Ethereum Treasury Surpasses $2 Billion as Holdings Cross 566,000 ETH

Bitmine Immersion Technologies has aggressively expanded its ethereum reserves, now exceeding $2 billion in value. The firm's holdings have surged to over 566,000 ETH, a significant milestone achieved shortly after closing a $250 million private placement.

The move underscores Bitmine's strategic focus on accumulating Ethereum as a core treasury asset. This accumulation aligns with growing institutional interest in ETH as both a store of value and a foundational blockchain platform.

Ethereum Price Prediction: $3,500 Threshold as Launchpad for New Rally

Ethereum has solidified the $3,500 level as a critical support zone, with institutional demand surging as capital rotates from Bitcoin. Spot ETFs have absorbed 1.36 million ETH this month—equivalent to 18 months of supply—against just 72,513 newly minted tokens. This supply shock coincides with record bearish positioning in CME futures, setting the stage for potential short-covering rallies.

Currently trading at $3,708, ETH has decisively broken through the $2,600-$2,700 resistance band. The $4,000 level now looms as the next psychological battleground, with a successful breach potentially triggering acceleration toward all-time highs. Technical analysis reveals a broadening wedge pattern dating to 2023, whose upper boundary NEAR $3,742 is being tested.

The convergence of institutional accumulation, extreme derivatives positioning, and bullish chart structure suggests Ethereum may be entering a parabolic phase. The measured move from the wedge pattern projects a $4,800 target, which WOULD eclipse the asset's previous peak.

AIDEN and INTMAX Partner to Enhance AI-Driven Decentralized Applications on Ethereum

AIDEN, an AI-powered Web3 search engine, has formed a strategic alliance with INTMAX Hub, a privacy-focused Layer-2 scaling solution on Ethereum. The collaboration aims to develop smarter, scalable decentralized applications by combining AIDEN's AI capabilities with INTMAX's high-speed, low-cost infrastructure.

INTMAX Hub leverages zero-knowledge proofs and Plasma architecture to deliver efficient, secure transactions. The integration will enable AI-driven services within the decentralized ecosystem, offering users enhanced functionality and engagement.

The partnership reflects growing convergence between artificial intelligence and blockchain scalability solutions. Ethereum's Layer-2 landscape continues to evolve as projects seek to address throughput limitations while maintaining privacy and security.

Ethereum Validator Exit Queue Hits Record High Amid Restaking Trend

Ethereum's validator exit queue has surged to a one-year peak of 521,000 ETH ($1.9 billion), requiring 19 days to process. Staking provider Everstake frames this not as capital flight but as strategic repositioning—validators are likely optimizing stakes or rotating operators rather than exiting the ecosystem.

While profit-taking remains possible after ETH's six-month price high, the backlog suggests structural shifts over panic. Market watchers note such churn may temporarily pressure prices but ultimately strengthens network resilience through stake redistribution.

Ethereum Price Forecast: SharpLink Hires Former BlackRock Executive Amid ETH Comeback

Ethereum treasury firm SharpLink Gaming has appointed Joseph Chalom, BlackRock's former Head of Digital Assets Strategy, as co-CEO. Chalom's two-decade tenure at BlackRock included pivotal roles in launching crypto products like the iShares Bitcoin Trust (IBIT) and iShares Ethereum Trust (ETHA). His move signals growing institutional interest in Ethereum's financial infrastructure.

Spot Ethereum ETFs continue their bullish streak with 15 consecutive days of net inflows, despite minor profit-taking activity. ETH currently trades at $3,650, down 2% on Friday, as markets eye the $4,100 resistance level following consolidation between $3,470-$3,780.

"I see a powerful opportunity to shape the future of decentralized finance," Chalom stated, underscoring Ethereum's expanding role in institutional portfolios. The hiring comes amid sustained demand for ETH from corporate treasuries and investment vehicles.

Ark Invest Cuts Coinbase, Boosts Ethereum & Tesla Holdings

Cathie Wood's Ark Invest has executed significant portfolio adjustments, reducing its stake in Coinbase while increasing exposure to Ethereum and Tesla. The move signals a strategic pivot toward assets with stronger growth narratives in both crypto and traditional tech sectors.

Ethereum's prominence in the reshuffle underscores institutional confidence in its upcoming protocol upgrades and deflationary mechanics. Tesla's inclusion reflects Ark's continued conviction in disruptive innovation beyond the digital asset space.

Octo Gaming Partners with Starknet to Launch Rollup-Powered Game

Octo Gaming, a social gaming platform with over 3 million users, has teamed up with Starknet, a Layer 2 scalability solution backed by the Starknet Foundation. The collaboration aims to leverage Starknet's rollup technology to enhance game speed, streamline transactions, and integrate mobile gaming into the Web3 ecosystem.

The partnership kicks off with the launch of "Bro Jump," an exclusive game inspired by the StarknetBro meme. Players tap, jump, and climb to earn rewards, with all actions processed instantly via Starknet's rollup infrastructure. This ensures seamless gameplay for millions of users without congesting the Ethereum base layer.

Starknet's validity rollup architecture combines Ethereum's security and decentralization with unlimited scalability. By settling transaction proofs on Ethereum, Starknet guarantees verifiable on-chain activity and secure asset management for players.

Ozzy Osbourne's CryptoBatz NFT Spikes 427% Posthumously Before Sharp Decline

CryptoBatz, the NFT collection tied to Ozzy Osbourne, saw a dramatic 427% surge in floor price following news of the artist's death on 22 July. The rally briefly shattered a long-standing resistance level at 0.06 ETH, reaching a three-year high of 0.0679 ETH before collapsing.

The speculative frenzy proved short-lived. Within days, trading volume plummeted 92% as risk-off sentiment engulfed digital collectibles. The broader NFT market capitalization fell 7.2%, with volumes down 31%—mirroring pullbacks across speculative crypto assets.

Ethereum-based NFTs bore the brunt of the selloff. While the Ozzy collection initially bucked the trend through panic bidding and thin order books, the pump faded rapidly. The episode highlights NFTs' continued volatility amid shifting market conditions.

How High Will ETH Price Go?

Based on current technicals and market structure, ETH shows strong potential to test the $4,118 upper Bollinger Band in the near term. The combination of:

| Indicator | Bullish Signal |

|---|---|

| Price vs 20-MA | 12.6% above moving average |

| MACD | Bullish convergence forming |

| Bollinger Bands | Price hugging upper band |

When coupled with institutional accumulation (566k ETH treasury) and developer activity (Starknet gaming partnerships), William suggests "$4,100 appears achievable before profit-taking emerges. A weekly close above $3,800 would confirm the next leg up."

shown_in_html